15 Terms Everyone in the Accounting Industry Should Know

Accountants have the opportunity to be an integral part of a business' or individual’s financial future. That being said, an accountant is not just somebody who happens to be good with numbers. They are well-trained professionals who, above all else, understand the facts that define what they do.

Before one can start crunching numbers, they must understand some very important terminology. With that in mind, here are 15 terms that everyone in the accounting industry should know:

1. Sarbanes-Oxley

This is one of the most important accounting laws of the past century. Created as a direct response to corporate scandals, such as the Enron calamity, this law holds accountants more responsible for the accuracy of a company's financial information and increases the severity of the penalties therein.

2. GAAP

The Generally Accepted Accounting Principles, also known as the GAAP, is an established set of standards for all accounting practices. The GAAP can vary from country to country.

3. Credit

When one hears the word credit, a Visa, MasterCard, Discover or American Express card normally comes to mind. In accounting, however, this term means something a little different. A credit is one half of the double entry accounting system that ensures a balance in one's accounting records. Certain types of accounts will be increased or decreased on the credit side, depending on the transaction.

4. Debit

This is the other half of the double entry accounting system. As with credits, certain accounts increase and decrease on the debit side, depending on the transaction. For example, a $100 cash sale will add a $100 debit to cash, while also adding a $100 credit to sales. When all transactions are accounted for, debit and credit totals should be equal on the balance sheet. If not, then the accountant must retrace his or her steps and figure out what went wrong.

5. Asset

An asset is anything of value to an organization. This includes, but is not limited to, cash, equipment, real estate, and inventory.

6. Liability

A liability is an obligation or debt created from a past business transaction. Even if a liability is a decade old, it is kept track of by an accountant until the account is fully settled and closed.

7. Accounts payable

This is the most common type of liability. An accounts payable is normally created when an organization borrows cash from someone else or makes a purchase on credit.

8. Accounts receivable

An accounts receivable is the exact opposite of an accounts payable. This type of account usually exists when an organization makes a sale on credit or loans cash.

9. Equity

Equity is how accountants look at the value of a company. If the value of a company's liabilities exceed those of their assets, then the equity is negative; if the opposite is true, then the equity is positive.

10. Cost of goods sold

When a company makes a sale, they lose inventory, which has a monetary value (determined by the amount that was paid for them). It is important to calculate this cost so that an organization can know the true value of a sale. For example, if a furniture company buys a couch for $500, then the cost of goods sold will be $500 when a customer buys it.

11. Capital

This is a commonly used term that is most often used to describe money. It can, however, mean many other things. This is due to the fact that the true definition of capital is the financial value of a company's assets.

12. Balance sheet

A balance sheet is a financial statement used to determine the financial health of a company. This is where all assets, liabilities, transactions and owner's equity will be assessed. As its name suggests, a balance sheet must have the same numbers on each side. The balancing formula for one of these statements is as follows:

Assets = Liabilities + Owner's Equity

13. General ledger

This is where all of the data on the balance sheet comes from. All transactions that occur are ultimately recorded on the general ledger. It is used to organize all of a company's accounting data.

14. General journal

Although all transactions must be recorded on a general ledger, everything is initially recorded in the general journal. A general journal is not used to make any official postings to any accounts; instead, it is just a record of the day's activities.

15. Net income

This is a company's bottom line for an accounting period. This is calculated by subtracting any transaction that can be considered to be "the cost of doing business" (expenses, taxes, asset depreciation, etc.) from revenues.

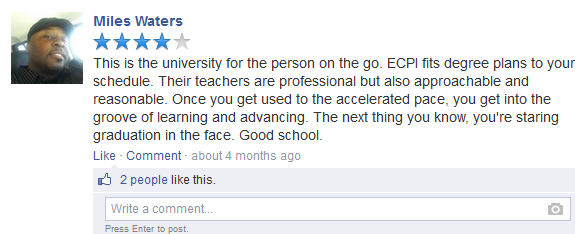

Are you interested in a degree in accounting? ECPI University offers a Bachelor of Science Degree in Business Administration with a concentration in Accounting that can be completed in as little as 2.5 years! Contact ECPI University TODAY to learn more! It could be the Best Decision You Ever Make!

DISCLAIMER – ECPI University makes no claim, warranty or guarantee as to actual employability or earning potential to current, past or future students or graduates of any educational program we offer. The ECPI University website is published for informational purposes only. Every effort is made to ensure the accuracy of information contained on the ECPI.edu domain; however, no warranty of accuracy is made. No contractual rights, either expressed or implied, are created by its content.

For more information about ECPI University or any of our programs click here: http://www.ecpi.edu/ or http://ow.ly/Ca1ya.